Top Excel accounting template for bookkeeping

Blog: Monday Project Management Blog

Let’s not beat around the bush here: your business can’t survive without accounting. Accounting is one of the most basic internal functions every business on the planet has to take care of — and it’s not hard to see why. Accounting is all about making sure you always have a clear view of your income, petty cash, cost management, your cash book, tax obligations, debts, paychecks, and everything else money-related you could possibly think of.

But that’s a lot to keep track of — especially if you’re working with a small team and don’t have much free time on your hands. That’s why many small business owners turn to an accounting template to help streamline the process of crunching numbers. But before you dive in head-first, there are a few important things you should know about Excel accounting templates and other accounting software.

In this article, we will explain what accounting is, how Excel accounting templates work, and how monday.com’s Accounting Template can take your organization’s accounting to the next level.

Get the monday.com Accounting Template now.

What is an Excel accounting template?

Like it or not, accounting is the lifeblood of every organization, from small businesses to large corporations. Accounting is all about recording all of your business transactions and then analyzing those transactions accordingly. Accounting teams then use this financial data and the analysis they’ve produced to create financial reports and summaries that can then be passed on to management, shareholders, and other internal teams.

But accounting teams must also report on transactions to government agencies, tax authorities, and industry-specific regulators.

Accounting for a business can be maintained by a bookkeeper, a trained accountant, or a small team. Meanwhile, larger corporations may have sprawling financial departments with multiple accounting teams.

Why is accounting important? Simply put, it tells you how your company is doing financially.

Accounting reports tell you whether you’re making a profit, what your cash flow looks like, the value of your assets and debts, and which parts of your organization are performing well. If you want to apply for a business loan or a grant, you need accounting statements on-hand to show your business is sustainable.

With that in mind, an accounting template is a pre-built accounting statement that you can download and customize to suit your own business needs. These templates are typically pre-populated or have a range of labeled columns — and then you simply fill in the blanks with your own financial information. There are a number of free accounting templates for Excel and Google Sheets available that you can download and import onto your desktop or web app.

Why use the Excel accounting template?

At this point, you might be reading all of this and panicking about making sure you’ve got somebody creating loads of airtight financial statements for your company. But a bookkeeper can handle the vast majority of a company’s basic accounting needs — although, if you’re a bigger company with complex accounting tasks, you’ll probably need to hire a Certified Public Accountant (CPA).

If you’re managing a small team and don’t have the resources to take on a full-time bookkeeper or accounting professional, don’t panic. You can create basic accounting spreadsheets using Microsoft Excel.

Because it’s the bread and butter of most trained accountants, you can find a lot of Excel accounting templates and just about every Excel bookkeeping template you could ever want, depending on your needs. For example, there’s a General Ledger Template for you to track any business expense, a Statement of Account Template, Credit Card Tracker Template, invoice templates, and more. There are also loads of third-party websites that offer free or cheap accounting templates and invoice templates in the form of downloadable Excel files.

Excel accounting templates are all about making life easier. If you’re new at this, having a clearly labeled template that can show you what values should be placed where is a total lifesaver.

But if you’re looking for a more flexible and dynamic accounting template with less manual labor involved, we’ve got you covered. But more on that in a minute. First, let’s talk about the different types of accounting templates.

What are some examples of Excel accounting templates?

Financial accounting templates

Financial accounting is an accounting system used to develop interim and annual financial statements during a given accounting period. This could include critical financial statements like a balance sheet statement, income statement, or cash flow statement — as well as double-entry bookkeeping.

An income statement is also often referred to as a “profit and loss statement,” and it simply summarizes all of a company’s net sales, net income, and expenses during a given period of time. There are a number of downloadable income statement templates you can use to record your income information in Excel spreadsheets.

There are also free balance sheet templates available on Excel. A balance sheet tells you how much your company is worth based on its “book value.” To find that value, you’d list all of your company liabilities, assets, and owners’ equity for a given reporting date.

Finally, you’ve got cash flow statement templates. A cash flow statement gives you a breakdown of what your company’s cash balances look like for a given period. There are loads of cash flow templates available on Excel and on a number of external sites that you can download for free.

Managerial accounting templates

Managerial accounting is similar to financial accounting, but instead of looking at various accounting dates, it focuses on monthly or quarterly reports. Managerial accounting statements enable you to analyze a company’s income and overheads to make important decisions about how your operations are funded and run. There are a number of managerial accounting templates on Excel — including budget templates and forecast templates.

Cost accounting templates

Cost accounting templates are used to analyze spending and make choices about how your business prices its products or services.

Translation: cost accounting is all about helping you develop price points to promote sales. You’ll encounter quite a few cost accounting templates on Excel and other third-party sites, although these will often be labeled as “cost sheets” or “costing templates.”

Our free Excel accounting template

If you’re on the hunt for the perfect Excel accounting template but can’t find any Microsoft templates that fit the bill, you should check out monday.com’s free Excel accounting template.

Our dynamic downloadable template comes with a range of pre-built financial reports. Each column is fully customizable, and all you’ve got to do is drag and drop your company’s financials to create fast and reliable financial statements to support your accounting function.

You can download our free Excel accounting template here. But if you want to remove all of the manual processes involved in accounting with Excel, we’ve got an even better solution available in the form of our fully-loaded Work OS Accounting Template.

monday.com’s Accounting Template

It’s totally possible to run a company’s accounting function offline using Excel. Many companies do it. But if you want to be able to handle all the core accounting functions we’ve covered without breaking a sweat, you may want to rethink Excel and check out monday.com’s Accounting Template.

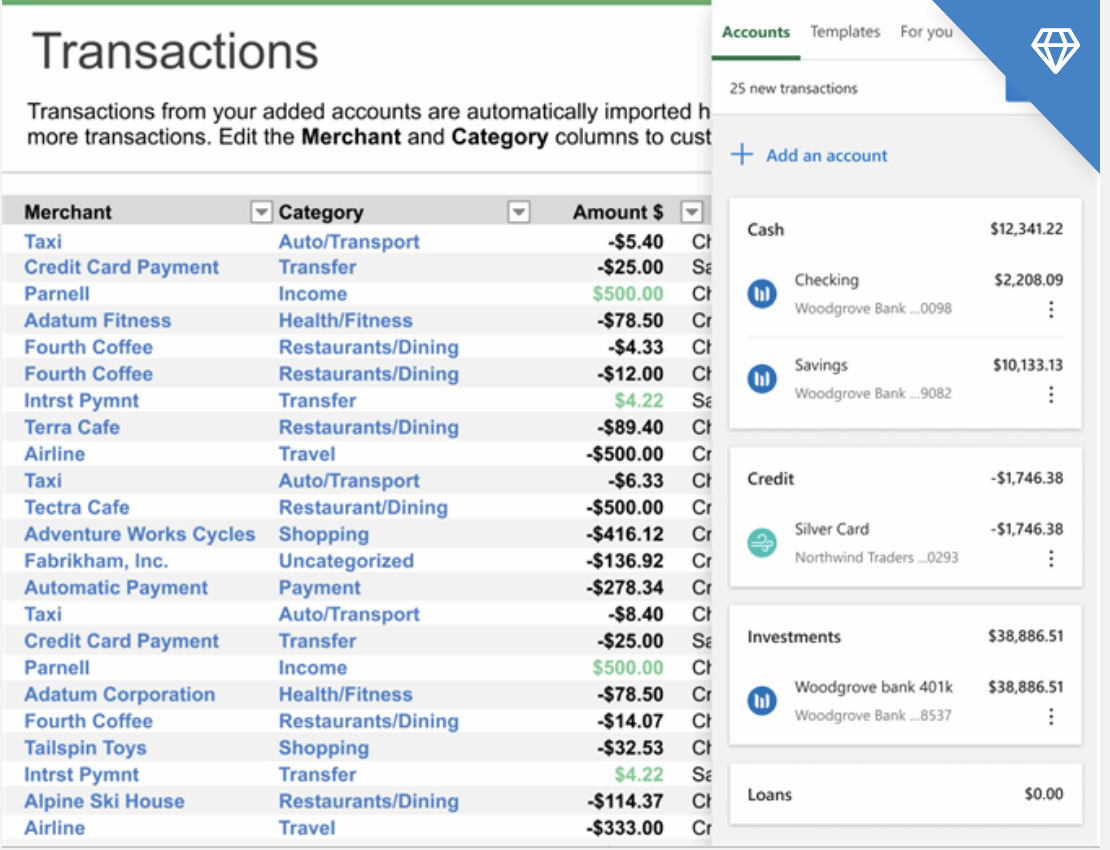

With our easy-to-use Accounting Template, you can consolidate all the accounting information and workflows in your business to manage everything on a single dashboard. This empowers you with a bird’s-eye view of all your finances. You’ll be able to automate financial reports, keep track of spending, set up spending alerts, and you’ll always know where you are in relation to your budget and income streams. This makes performing financial audits a breeze.

And if you really love a particular Excel accounting template — like ours — you can even use it alongside monday.com’s more dynamic template. With the help of our set of handy integrations, you can easily import Excel workbooks onto your monday.com dashboard and use that data to contribute to your wider works on monday.com.

Get the monday.com Accounting Template now.

Related templates

Financial Statements Template

If you’re focusing less on overall accounting and more on just your financial statements, our Financial Statements Template will fit the bill. You can use this template to manage capital investments, track debts and repayment schedules, and manage corporate audits — all while setting up rules and automations that will keep a running score of your core financial statements like your balance, income, and cash flow.

Expense Tracking Template

Our Expense Tracking Template is designed to help you regain control of your finances with a fast and simple proactive approach. This template offers live updates on all of your project or organization’s financials for any given period. But it also gives you the chance to skip ahead and forecast where your existing financials will be in the days, weeks, and months ahead.

Get the monday.com Accounting Template now.

FAQs about Excel accounting templates

How do you record income and expenses in Excel?

Creating a simple expense and income spreadsheet can help you manage your company’s finances — and they’re pretty easy to create. Simply make a list on Excel and format that list as a table or chart of accounts. You can then add headers describing each expense or income stream, the relevant date, and how it’s impacted your total financials.

How do you keep books of accounts in Excel?

If you know what you’re doing, it’s possible to perform all of the core bookkeeping software functions for a business on Excel. But there’s a lot to do. You’ll need to create an excel sheet as an invoice tracker, create a financial transaction tracker, set up multiple managerial accounting spreadsheets to keep tabs on operational expenditure — not to mention prepare income statements and cash flow statements.

These financial records will need to be constantly added into an up-to-date company ledger, which is essentially your master accounting template. Excel does offer a basic, pre-built company ledger template.

Customized banner CTA*

The post Top Excel accounting template for bookkeeping appeared first on monday.com Blog.

Leave a Comment

You must be logged in to post a comment.